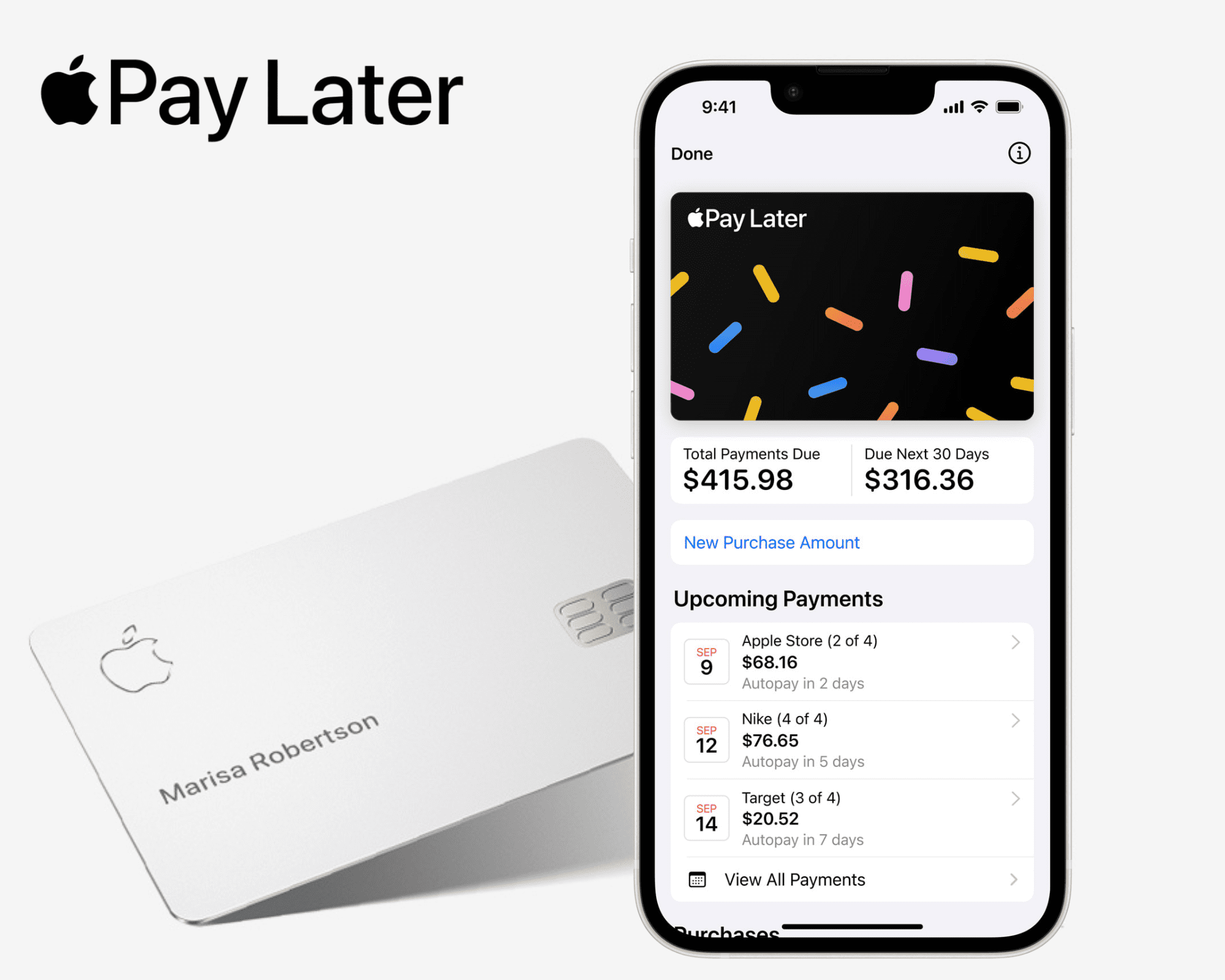

In a notable shift, Apple has announced the discontinuation of its Apple Pay Later service, which allowed users to pay for purchases in four installments over six weeks. Despite being fully launched in the U.S. in October 2023, the service will no longer accept new loans, though existing ones will remain unaffected. Instead, Apple is transitioning to offering installment loans through credit and debit cards and third-party lenders.

Apple confirmed this change to 9to5Mac, emphasizing its dedication to providing secure and flexible payment options. A company statement highlighted that this new global installment loan offering aims to bring flexible payments to more users worldwide in collaboration with banks and lenders supporting Apple Pay.

The service offered interest-free loans ranging from $50 to $1,000, manageable through Apple Wallet and reported to Experian, though not to other credit bureaus. This pivot coincides with the upcoming iOS 18 release, anticipated in September, which will include built-in support for third-party buy now, pay later (BNPL) services like Affirm.

During Apple’s recent Worldwide Developers Conference (WWDC), the company highlighted partnerships with financial giants such as Citigroup and Synchrony Financial, which will facilitate BNPL loans through Apple Pay. This strategic shift reflects Apple’s plan to streamline its payment services and expand its global reach.

This decision mirrors Apple’s efforts to balance innovation with practicality, ensuring its services remain user-friendly and accessible. Moving away from a proprietary BNPL service to partnerships with established financial entities suggests a strategic shift towards leveraging existing financial infrastructure to enhance Apple Pay’s capabilities.

While the discontinuation of Apple Pay Later may surprise some, it highlights Apple’s adaptive approach to evolving market dynamics. By collaborating with established financial institutions and integrating third-party BNPL services, Apple aims to provide a extensive and globally accessible payment solution.

As Apple continues to refine its financial services, users can expect improved functionality and broader reach, reinforcing Apple Pay’s position as a leader in secure, flexible payment solutions. This transition marks a important step in Apple’s journey toward creating a seamless, integrated financial ecosystem for its users.

If you liked this story, please follow us and subscribe to our free daily newsletter.